Office No. M06, Mezzanine Floor, Alphamed Building, Abu Hail Road, Hor Al Anz East, Dubai, UAE.

LocationMuzhakkunnu, Muzhakkunnu PO, Peravoor Via, Kannur (Dist), Kerala, 670673.

VAT Refund Update

Under Federal Decree-Law No. 17 of 2025, a new 5-year statutory limitation period for VAT refund applications will come into effect starting 1 January 2026.

Key Change in Summary

Businesses will have a maximum of 5 years from the end of each tax period to submit VAT refund claims.

After this window expires, the right to recover that VAT is permanently forfeited.

What the New Rule Means

Ø VAT refund claims must be submitted within 5 years from the end of the respective tax period — claims beyond this window will no longer be recoverable.

Ø Refund requests submitted during the 5th (final) year may trigger extended FTA audit review, as older records carry higher verification requirements.

Ø Refund request submissions made shortly before expiry (within 90 days) may still be accepted, but are expected to undergo more thorough examination by the FTA.

Why This is Crucial for Your Business

Ø VAT credits accumulated from 2021 and previous years may expire soon if left unclaimed.

Ø Businesses delaying refund applications risk converting recoverable VAT into a permanent expense.

Ø Strong supporting documentation will be essential — including verified tax invoices, import records, bank proof, contracts, capital asset schedules, and evidence of taxable activity.

Our Recommendation

Businesses should immediately review historic VAT balances and initiate refund submissions without delay to avoid time-barred losses.

Explaining the above provision with real life scenario…………

Scenario:

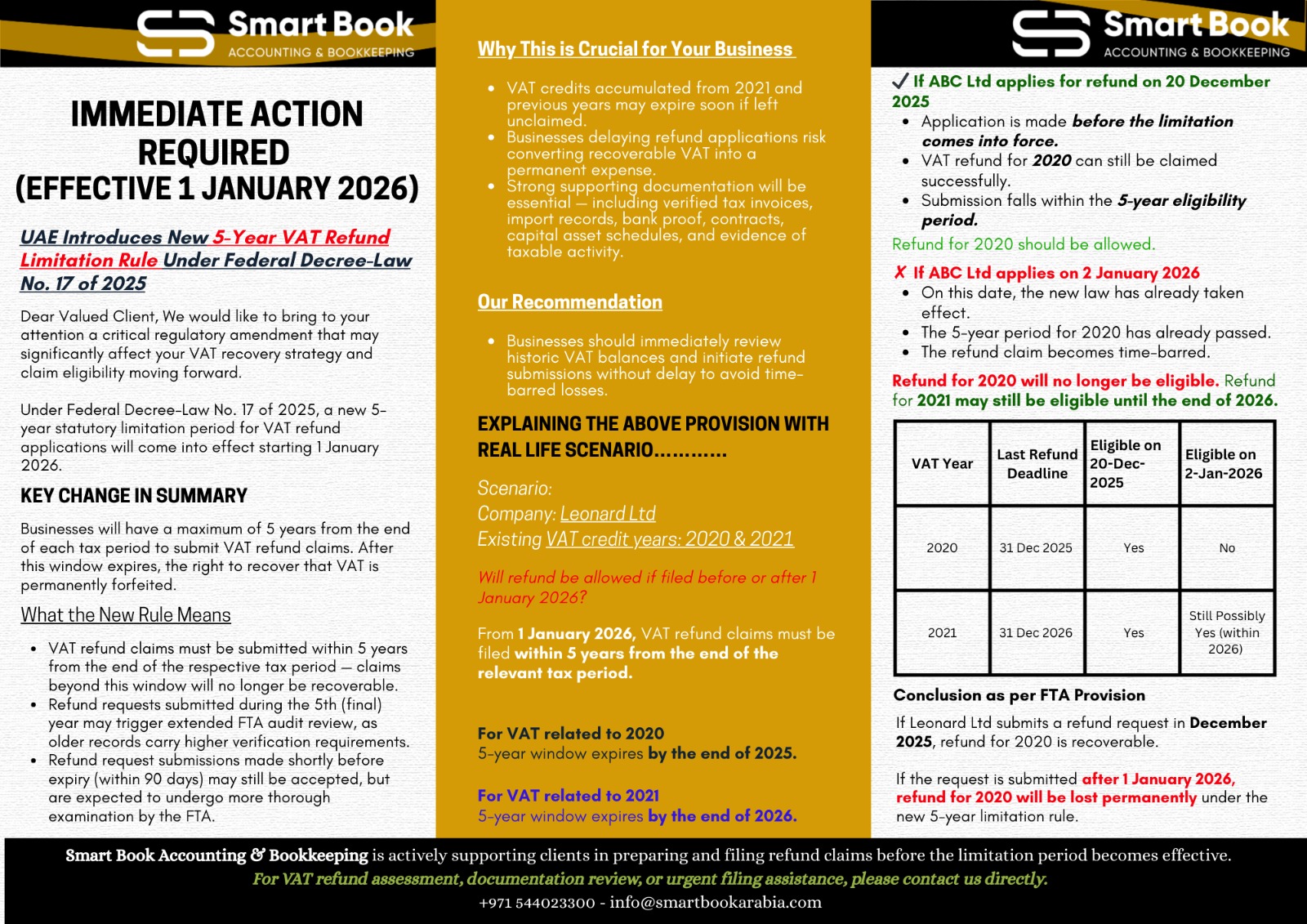

Company: Leonard Ltd

Existing VAT credit years: 2020 & 2021

Will refund be allowed if filed before or after 1 January 2026?

From 1 January 2026, VAT refund claims must be filed within 5 years from the end of the relevant tax period.

For VAT related to 2020

5-year window expires by the end of 2025.

For VAT related to 2021

5-year window expires by the end of 2026.

✔ If ABC Ltd applies for refund on 20 December 2025

- Application is made before the limitation comes into force.

- VAT refund for 2020 can still be claimed successfully.

- Submission falls within the 5-year eligibility period.

Refund for 2020 should be allowed.

✘ If ABC Ltd applies on 2 January 2026

- On this date, the new law has already taken effect.

- The 5-year period for 2020 has already passed.

- The refund claim becomes time-barred.

Refund for 2020 will no longer be eligible.

Refund for 2021 may still be eligible until the end of 2026.

Conclusion as per FTA Provision

If Leonard Ltd submits a refund request in December 2025, refund for 2020 is recoverable.

If the request is submitted after 1 January 2026, refund for 2020 will be lost permanently under the new 5-year limitation rule.

.png)